Conceptually, retained earnings reflect the cumulative earnings kept by a company since its inception rather than distributing excess funds in the form of shareholder dividends. The following chart contains some of the most common metrics used in practice to analyze a company’s balance sheet. Similar to the order in which assets are displayed, liabilities are listed in terms of how near-term the cash outflow date is, i.e. the near-term liabilities coming due on an earlier date are listed at the top. Once complete, we’ll undergo an interactive training exercise in Excel, where we’ll practice building a balance sheet template using the historical data pulled from the 10-K filing of Apple (AAPL).

Liabilities

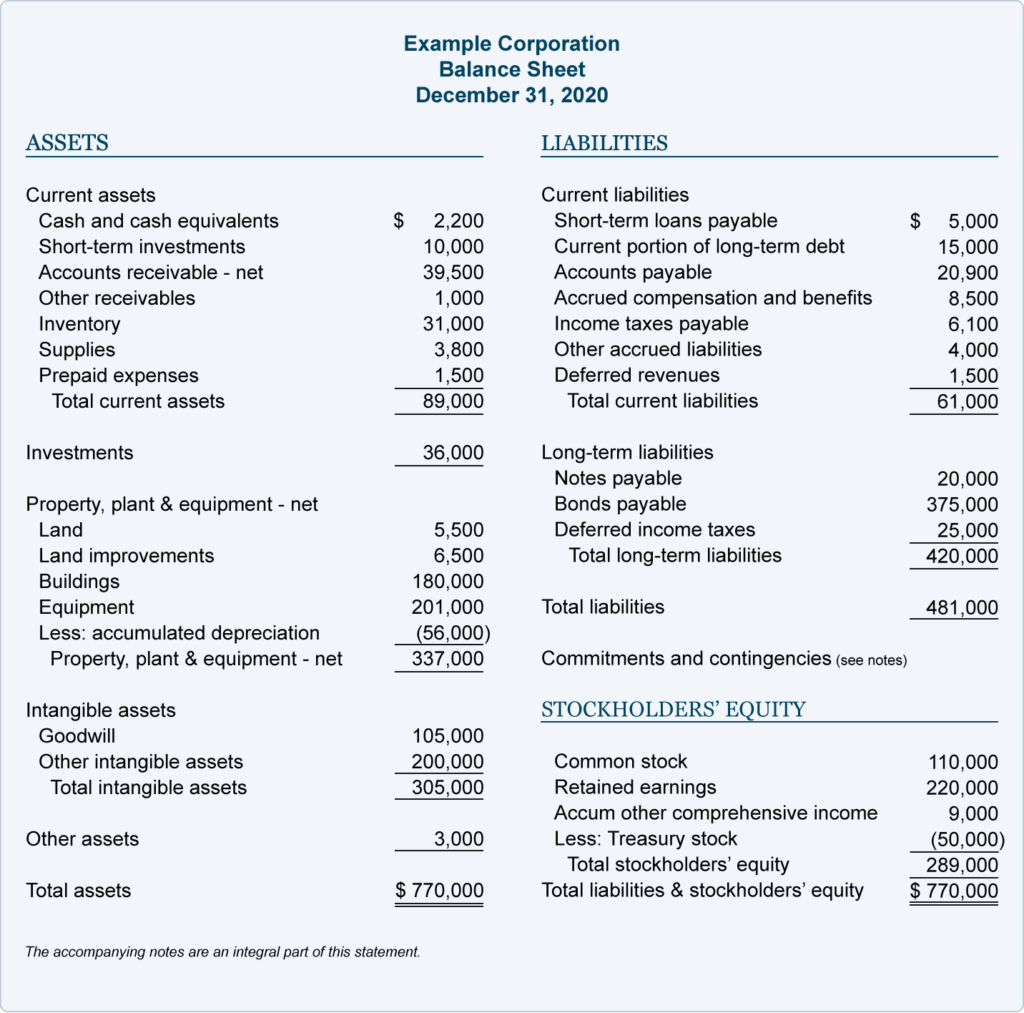

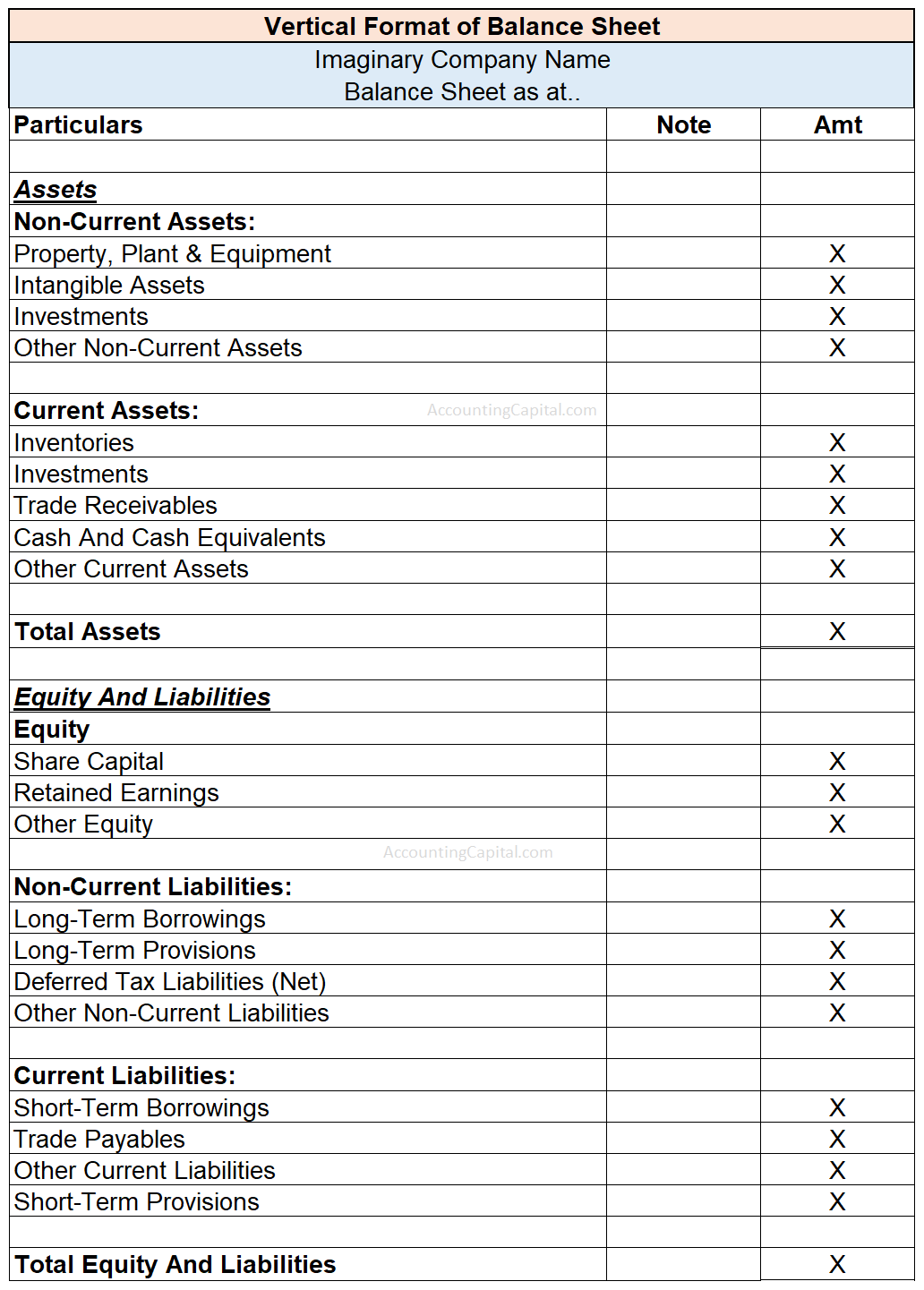

Financial position refers to how much resources are owned and controlled by a company (assets), and the claims against them (liabilities and capital). Assets, liabilities and capital balances are reported in a balance sheet, which is also known as statement of financial position. The term owners’ equity is mostly used in the balance sheet of sole proprietorship cash book definition how it works types and advantages and partnership form of business. In a company’s balance sheet, the term owners’ equity is often replaced by the term stockholders’ equity. All assets that are not listed as current assets are grouped as non-current assets. A common characteristic of such assets is that they continue providing benefit for a long period of time – usually more than one year.

Assets Section (Current vs. Non-Current)

It will also show the if the company is funding its operations with profits or debt. This form is more of a traditional report that is issued by companies. Find more balance sheets and accounting templates in this collection of the top Excel templates for accounting.

- Your assets are everything that belongs to your business; for example, the money in your account, investments and physical capital.

- The revenues of the company in excess of its expenses will go into the shareholder equity account.

- The balance sheet is essentially a picture a company’s recourses, debts, and ownership on a given day.

- A Product Registration Form is a form template designed to facilitate the registration of purchased products by consumers with the manufacturer or seller.

How to use templates

Keep track of who’s borrowing company equipment with this free online form. In every organization or company, it is necessary to record all the items stored in the inventory. You can use this Inventory Checklist Form Template to track and control the products in an organized manner. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information.

These operating cycles can include receivables, payables, and inventory. Below is an example of a balance sheet of Tesla for 2021 taken from the U.S. Current liabilities refer to the liabilities of the company that are due or must be paid within one year. When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time.

How Balance Sheets Work

A company may look at its balance sheet to measure risk, make sure it has enough cash on hand, and evaluate how it wants to raise more capital (through debt or equity). In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased.

A balance sheet organizes all of this information in a way that is easy to read and understand. You can create yours today with the help of the balance sheet template from FreshBooks. Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued.

This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable. A time tracker form is a questionnaire used by businesses to collect information from employees about their time spent working. If you’re exporting or importing products overseas, you need a commercial invoice. The column headers are the item ID, description, weight, quantity, and the price.

Shareholders’ equity will be straightforward for companies or organizations that a single owner privately holds. Again, these should be organized into both line items and total liabilities. Often, the reporting date will be the final day of the reporting period. Companies that report annually, like Tesla, often use December 31st as their reporting date, though they can choose any date. This stock is a previously outstanding stock that is purchased from stockholders by the issuing company. If the company wanted to, it could pay out all of that money to its shareholders through dividends.